Funds advised by Apax Partners to acquire Tosca Services

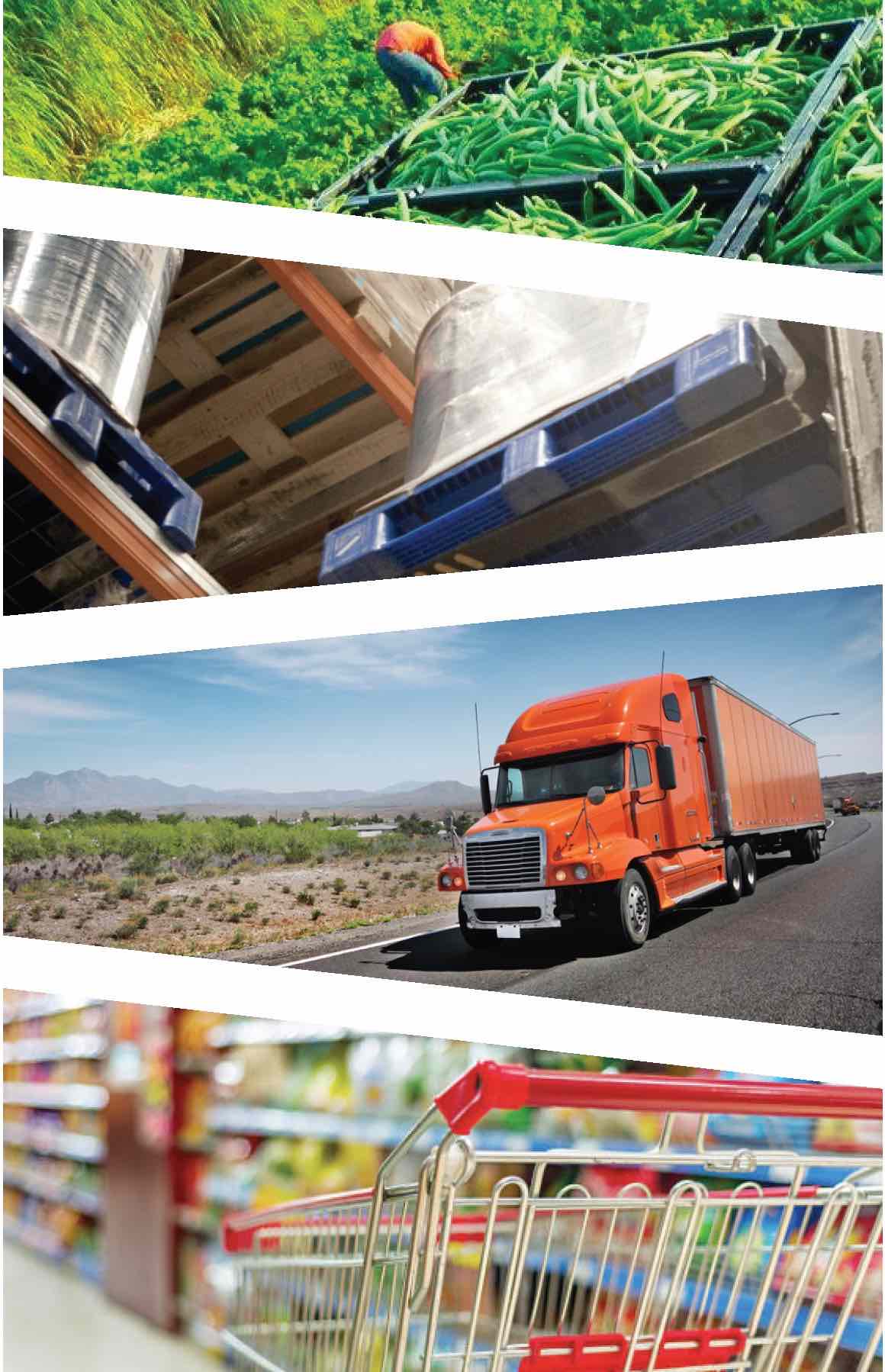

Atlanta (October 2, 2017) – Funds advised by Apax Partners (“Apax Funds”) have today announced a definitive agreement to acquire Tosca Services, LLC (“Tosca”), a leading provider of supply chain solutions and reusable packaging to the perishable markets of protein, eggs, produce and cheese. Existing shareholders will retain a minority ownership position in the company. The transaction is subject to customary closing conditions and is expected to close in Q4 2017. Terms of the transaction were not disclosed.

Founded in 1959, Tosca has a rich history of innovation that has driven its growth from a regional cheese barrel refurbishment business into a leading North American enterprise focused on supply chain solutions and reusable packaging across a wide array of perishables, including eggs, beef, pork, poultry and produce. The company today employs over 500 people and operates 14 service centers across the United States working with the nation’s largest and most influential grocery retailers and suppliers.

“Tosca’s reusable packaging solutions drive improved efficiencies throughout the entire perishable supply chain, resulting in substantial business benefits and a better overall customer experience,” said Eric Frank, president and CEO of Tosca. “There is significant momentum in the market for reusables and we are excited about the continued growth opportunities Apax affords us.”

Ashish Karandikar, a partner at Apax Partners, said: “This is a prime example of Apax partnering with a strong management team in one of our core industry sectors. Through Apax Funds’ previous ownership of a reusable plastic container pooler, we have developed an appreciation for the growth opportunity within grocery supply chain and have over the years been deeply impressed by Tosca’s stellar track record of innovation and growth.

“In today’s complex and fast-changing grocery environment, challenged by increasing pricing competition, grocers need a solution like Tosca’s that drives supply chain efficiency and simplicity while also positively impacting the environment. We see significant opportunities for the company to continue to innovate and are delighted to work alongside the existing management team as the company enters its next phase of growth.”

Apax Partners was advised by Simpson Thacher & Bartlett LLP (legal counsel) and KPMG (accounting advisor).

Tosca was advised by William Blair & Company LLC (financial advisor), Kirkland & Ellis LLP (legal counsel), RSM US LLP and PriceWaterhouseCoopers, LLP (accounting advisors).

About Apax Partners

Apax Partners is a leading global private equity advisory firm. Over its more than 30-year history, Apax Partners has raised and advised funds with aggregate commitments in excess of $48 billion*. The Apax Funds invest in companies across four global sectors of Tech and Telco, Services, Healthcare, and Consumer. These funds provide long-term equity financing to build and strengthen world-class companies.

The Apax Funds have been a leading private equity investor in the Services sector, having completed over 22 buyout investments in this sector since 2001. Apax’s deep sector expertise and global resources have helped accelerate organic and inorganic growth within the Apax Funds’ portfolio and enabled geographic expansion. Notable current and past route-based Services investments include IFCO, Azelis, Rhiag, Garda World, Safetykleen Europe and Sulo. For further information about Apax Partners, please visit www.apax.com.

*Funds raised since 1981, commitments converted from fund currency to USD at FX rates as at 30 June 2017.

About Tosca, Services LLC.

Based in Atlanta, GA, Tosca provides innovative supply chain solutions and reusable packaging across a diverse range of perishable markets including eggs, produce, protein, and cheese. Tosca collaborates with growers, suppliers and retailers to deliver the best flow of perishables throughout the entire supply chain. Tosca’s reusable plastic containers – the most comprehensive portfolio in the industry – improve product protection, lower costs and are more sustainable than single-use packaging.